Increase Efficiencies and Protect Client Data with Consensus’ Solutions for the Insurance Industry

Secure, Risk-free, Digital Faxing and eSignature Solutions for the Modern Insurance Company

The Unique Challenges Facing Insurance Companies

All types of insurance entities, such as brokers, managing general agencies (MGAs), and third-party administrators (TPAs) — continue to rely on paper faxing to transmit documents containing highly sensitive client data, using outdated, paper-based faxing equipment.

Paper-based faxing creates several challenges. First, legacy fax processes leave significant security and regulatory vulnerabilities. Hardcopy documents containing clients’ coverage details, personal data, medical records, or financial information can be easily viewed or taken by unauthorized personnel if left sitting on a fax machine or printer — or even if filed in an unlocked cabinet.

Manage Data and Mitigate Risk

Insurance companies today must have the ability to securely exchange data with clients, partners and legal entities. Relying on a paper-based faxing infrastructure makes it nearly impossible for agents to meet their company’s essential everyday responsibilities, including:

- Receiving, signing, and responding quickly to important faxes, from any destination

- Complying with ABA and federal privacy rules regarding client communications

- Reviewing regulatory changes and assessing their impact

- Sharing documents that enable employees to easily and consistently track state underwriting laws and regulations across multiple jurisdictions

Many forward-thinking insurance companies have chosen to upgrade from their legacy paper fax environments to our modern, digital cloud faxing solution and secure, digital signature tool in answer to these on-going challenges.

Boost your Company’s Productivity

eFax Corporate enables your team to fax anywhere — and respond quickly via email from any smartphone, tablet or computer.

Learn more about how insurance companies can increase reliability and lower liability.

Read the customer success story eFax and a National Insurance Company.

Why Insurance Companies Prefer

eFax Corporate® transforms your outdated paper fax processes, transmissions and fax servers to a faster, more convenient, and cost-effective alternative.

The first and only global fax solution truly built in the cloud. Cloud-native technology ensures that we can seamlessly and continuously upgrade our infrastructure’s security protocols to protect your company’s fax data, while providing storage capacity that exceeds your company’s needs, both now and in the future.

No couriers required. The “receipt” – is your secure, legal proof that your digital fax has reached its intended party.

Key Benefits of eFax Corporate

Insurance companies today must have the ability to securely exchange data with clients, partners and legal entities. Relying on a paper-based faxing infrastructure makes it nearly impossible for agents to meet their company’s essential everyday responsibilities, including:

- Respond more quickly to clients, partners, and third parties

- Lower your company’s overall faxing costs, including paper, ink and printing supplies

- Increase data security – securely send any type of digital document without risk

- Ensure compliance with key regulations and standards

- Empower your agents to spend more time with clients and core processes

Safe, Efficient and Compliant

eFax Corporate’s secure digital fax solution employs the highest standards in securing and encrypting your data in transit and storage with TLS encryption, and also helps keep your faxing processes on the right side of state and federal regulators. Our cloud faxing solution helps you improve compliance with regulatory standards and eliminates tedious, administrative tasks during processing.

Get The Competitive Advantage of eSigning – with  Digital Signature

Digital Signature

Increase Productivity, Decrease Manual Paperwork

With jSign digital signature, your staff will benefit from faster transactions – from on-boarding to claim settlement. Plus, jSign meets the security, regulatory, and legal requirements to process forms, policies, claims, applications, declarations, insurance certificates, and more in just one easy-to-use platform.

Optimize Document Workflows and Increase Your Bottom Line

Wet ink may be the traditional way of signing insurance documents, but electronic signatures offer a wide range of features and benefits that can’t be matched by traditional methods of signing.

Traditional signing vs. digital signature

Wet Ink Processing

- Prone to error

- Time-consuming

- High costs

- Not secure or compliant

Signing and Approving with jSign

- Automated signing process

- Flexible: Sign anywhere, anytime

- Cost-effective

- Secure: Immutable ledger system encrypted; two-factor authentication

eSignatures Backed by Blockchain

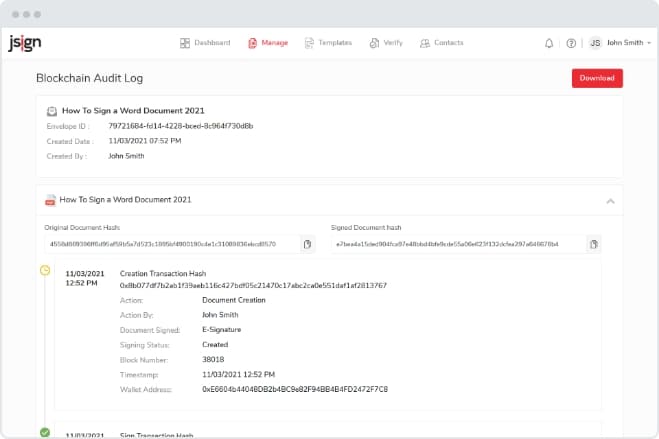

Not all electronic signature services are created equal, and no one wants to question the integrity of their digitally-signed documents. With jSign, every action taken with a document is logged and timestamped using blockchain – the most secure database technology, which helps prevent fraud, false signatures, or other types of tampering.

Key jSign Benefits:

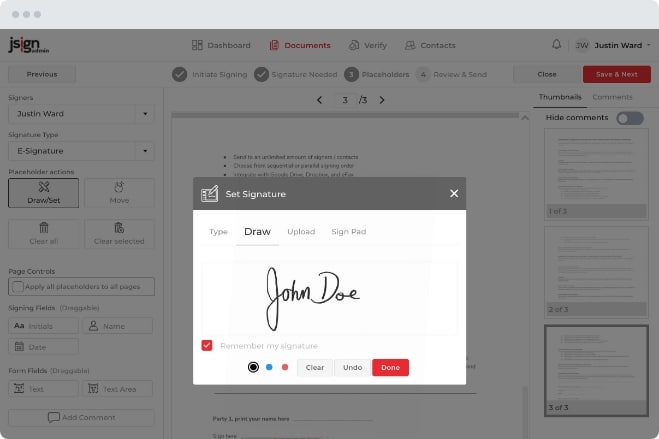

- Sign in a variety of ways: enter a digital signature or capture a hand-written signature; select from predefined signatures; upload a signature image

- Enable signing location restrictions to manage jurisdictions

- Receive certificate of completion when documents are officially signed and view a full audit trail with timestamps to track documents

- Set two-factor authentication through mobile number and email